As the new year approaches, Medicare beneficiaries are eagerly awaiting updates on the 2025 premiums. One crucial aspect to consider is the Income-Related Monthly Adjustment Amount (IRMAA) brackets and surcharges that apply to Medicare Parts B and D. In this article, we will delve into the details of IRMAA brackets and surcharges for 2025, helping you navigate the complexities of Medicare premiums.

What is IRMAA?

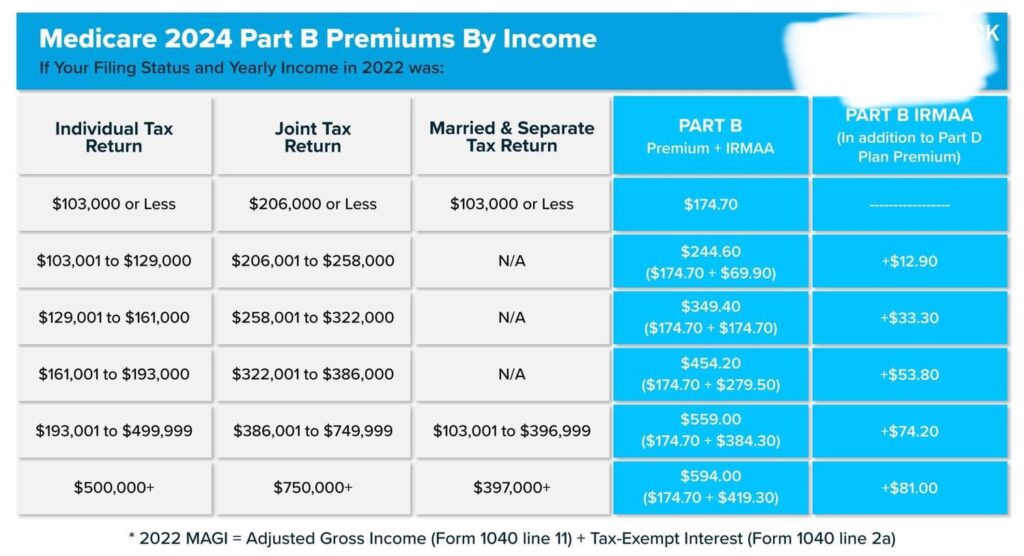

IRMAA is a surcharge applied to Medicare Part B and Part D premiums for beneficiaries with higher incomes. The amount of the surcharge depends on the beneficiary's income level, which is determined by their tax filing status and modified adjusted gross income (MAGI). The IRMAA brackets are adjusted annually to reflect changes in the cost of living.

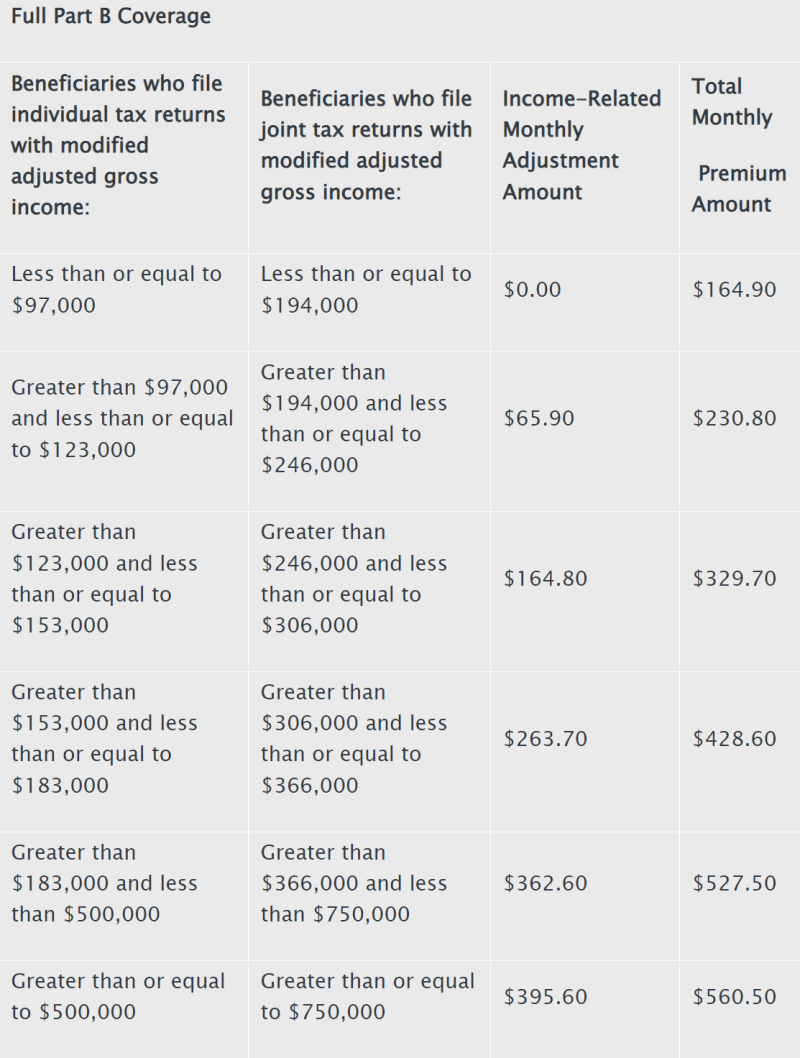

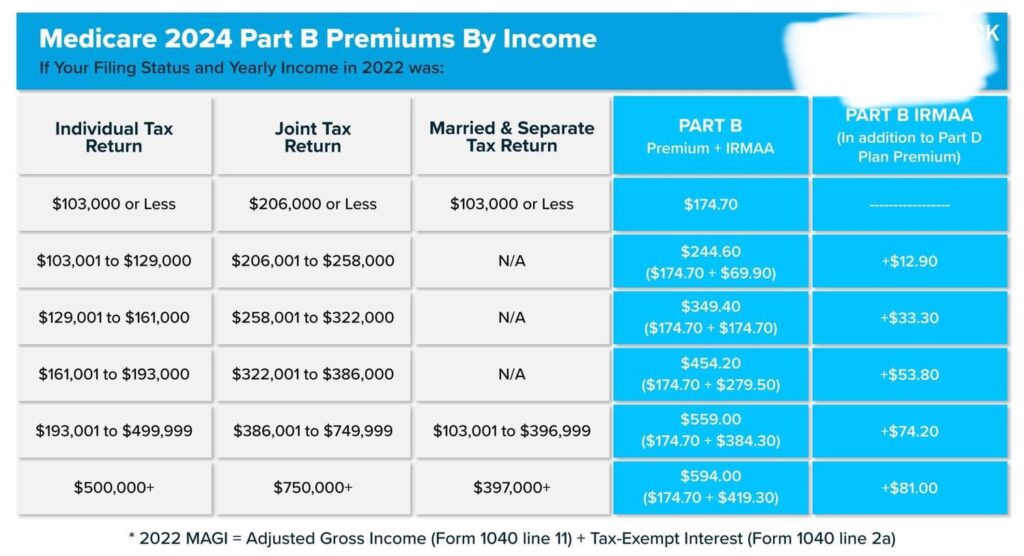

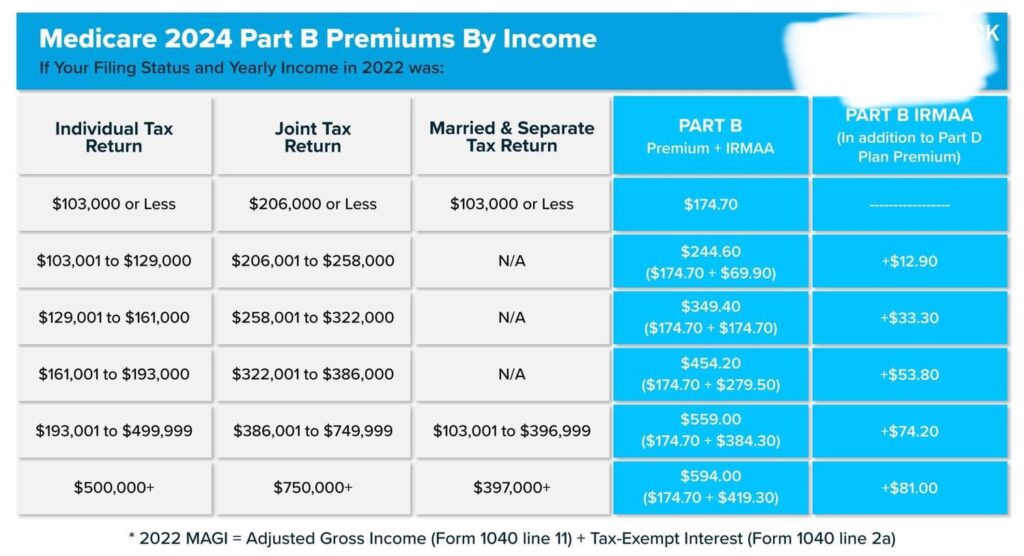

2025 IRMAA Brackets for Medicare Part B

The 2025 IRMAA brackets for Medicare Part B are as follows:

Beneficiaries with incomes between $97,000 and $123,000 (single filers) or $194,000 and $246,000 (joint filers) will pay a surcharge of $65.90 per month.

Beneficiaries with incomes between $123,001 and $153,000 (single filers) or $246,001 and $306,000 (joint filers) will pay a surcharge of $164.80 per month.

Beneficiaries with incomes between $153,001 and $183,000 (single filers) or $306,001 and $366,000 (joint filers) will pay a surcharge of $263.70 per month.

Beneficiaries with incomes above $183,001 (single filers) or $366,001 (joint filers) will pay a surcharge of $362.60 per month.

2025 IRMAA Brackets for Medicare Part D

The 2025 IRMAA brackets for Medicare Part D are as follows:

Beneficiaries with incomes between $97,000 and $123,000 (single filers) or $194,000 and $246,000 (joint filers) will pay a surcharge of $12.20 per month.

Beneficiaries with incomes between $123,001 and $153,000 (single filers) or $246,001 and $306,000 (joint filers) will pay a surcharge of $31.50 per month.

Beneficiaries with incomes between $153,001 and $183,000 (single filers) or $306,001 and $366,000 (joint filers) will pay a surcharge of $50.70 per month.

Beneficiaries with incomes above $183,001 (single filers) or $366,001 (joint filers) will pay a surcharge of $70.00 per month.

How to Reduce Your IRMAA Surcharges

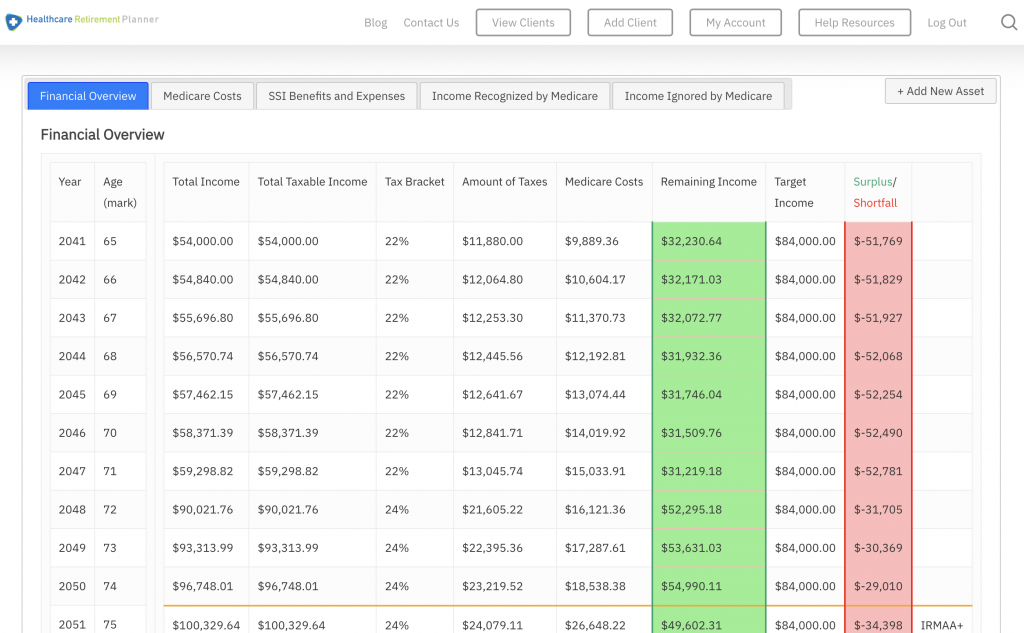

If you are subject to IRMAA surcharges, there are ways to reduce your premiums. One option is to appeal your IRMAA determination if you experience a life-changing event, such as retirement or divorce, that affects your income. You can also consider consulting with a financial advisor to optimize your income and reduce your tax liability.

Understanding the IRMAA brackets and surcharges for Medicare Parts B and D is essential for beneficiaries who want to navigate the complexities of Medicare premiums. By knowing the 2025 IRMAA brackets and surcharges, you can better plan for your healthcare expenses and make informed decisions about your Medicare coverage. Remember to review your income and adjust your Medicare premiums accordingly to avoid any unexpected surcharges.

Note: The information provided in this article is subject to change and may not reflect the actual 2025 IRMAA brackets and surcharges. It's essential to consult the official Medicare website or contact a licensed insurance agent for the most up-to-date information.